Master Pillar Two compliance with QDMTT and IIR computations, GloBE ETR and GIR XML filing.

Pillar Two

Pillar Two compliance, automated and audit-ready.

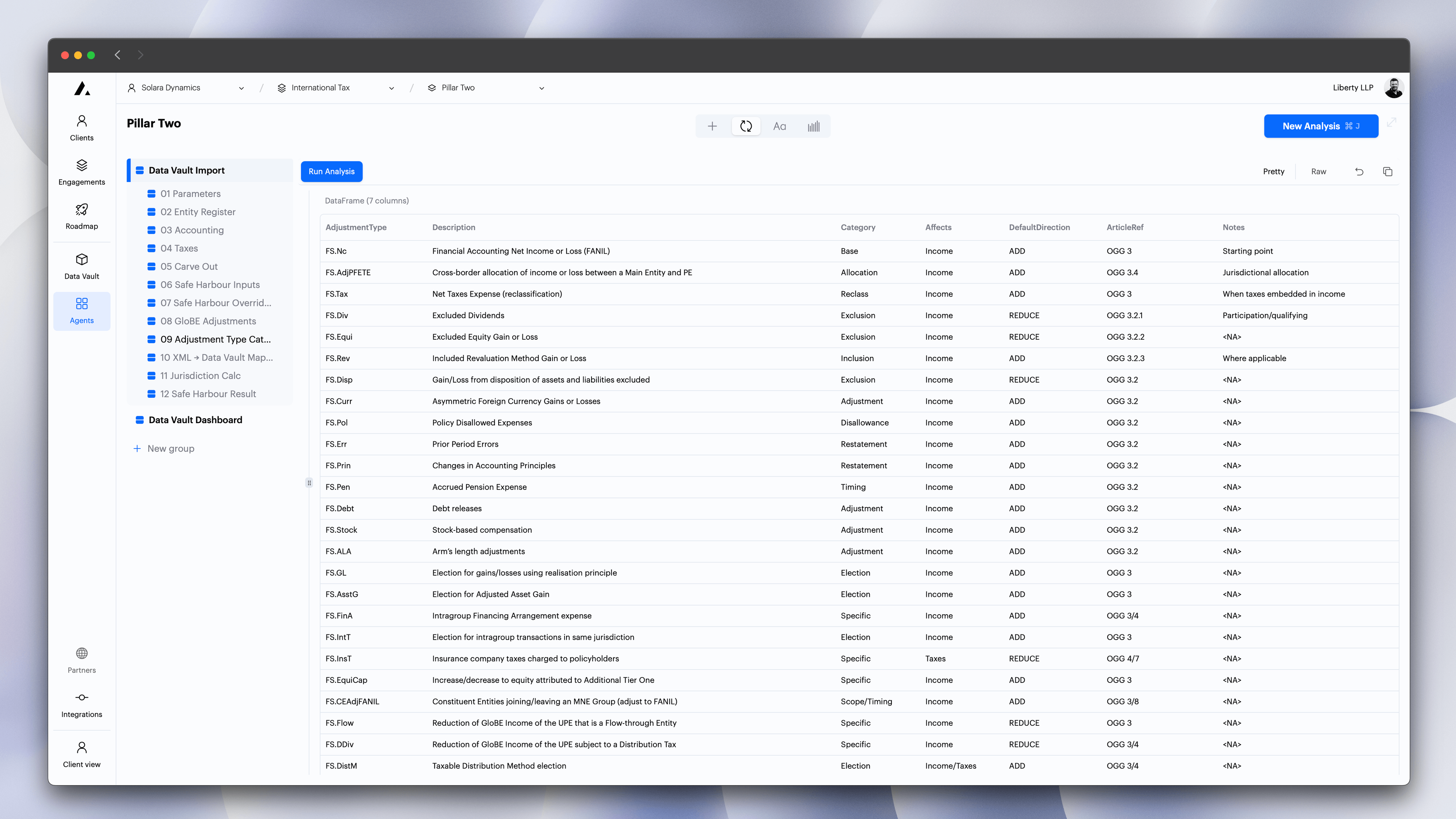

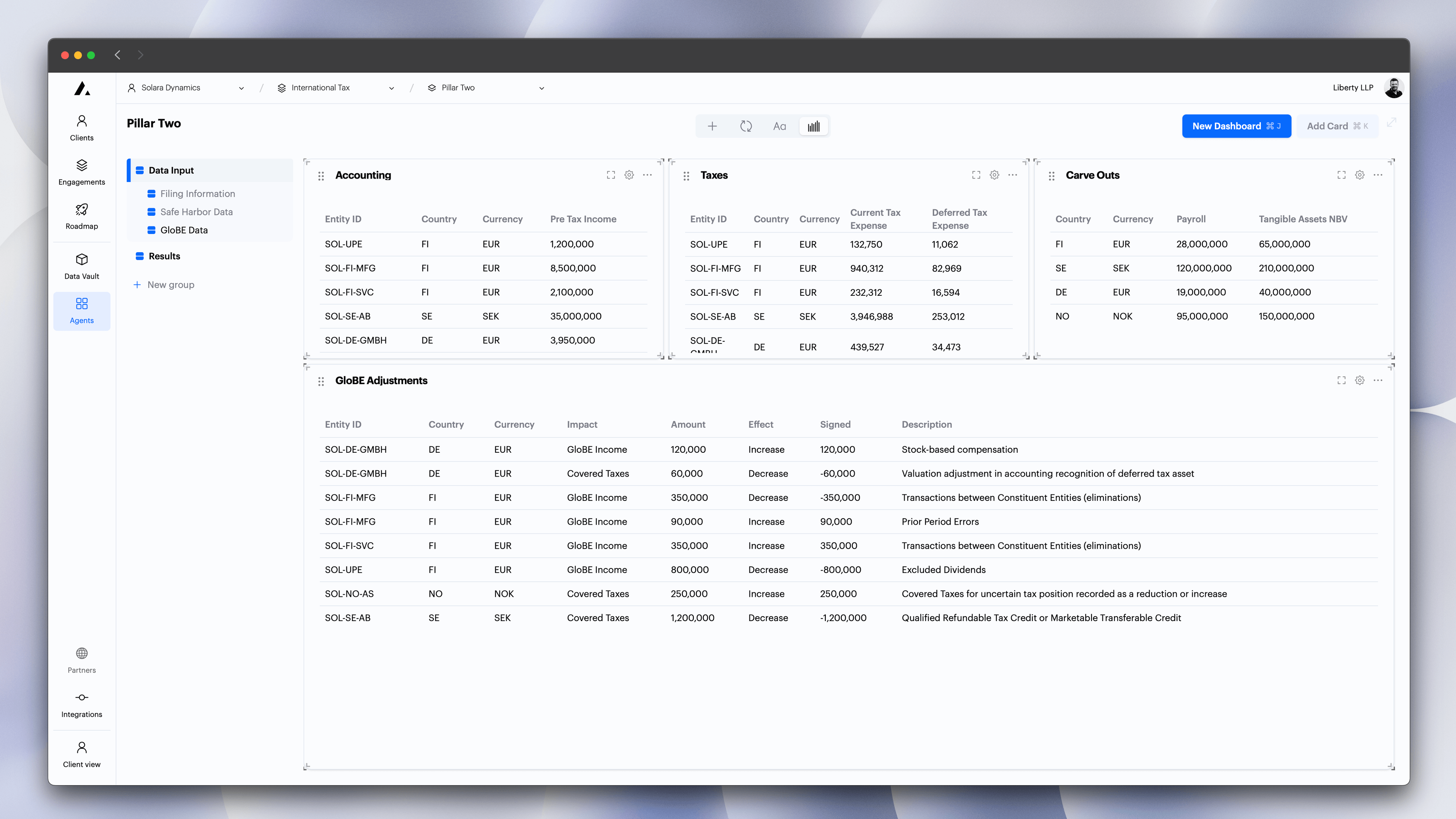

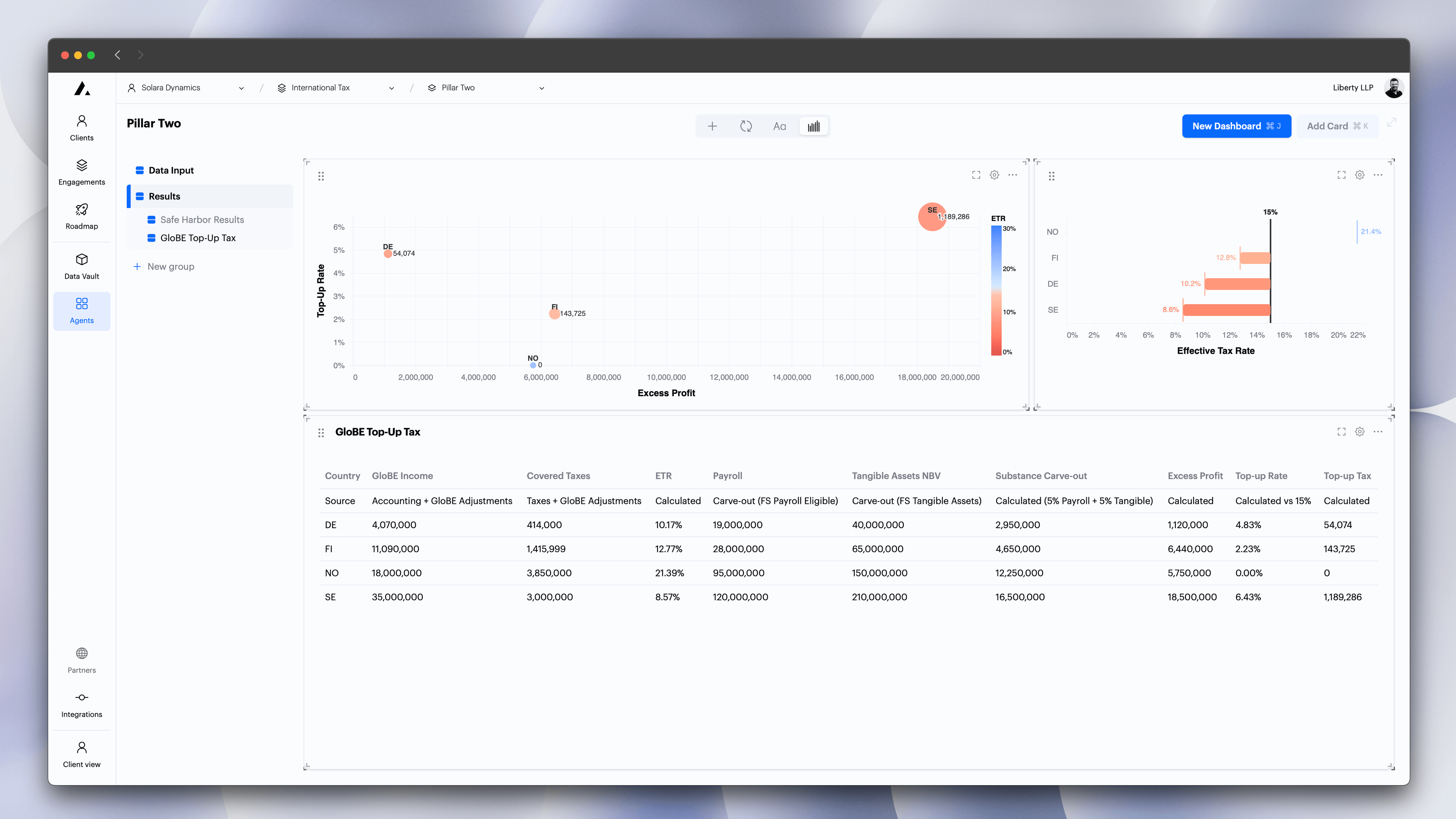

Supernomial's Pillar Two agent computes jurisdictional GloBE ETRs and Top-Up Taxes and manages QDMTT/IIR/UTPR workflows, filings, and evidence. Flexible by design, it adapts to local implementations (incl. transitional-qualified regimes) and safe harbours, with built-in GIR XML generation and validation.

Key Features

- QDMTT, IIR and UTPR engines with substance carve-outs, GloBE adjustments to income and covered taxes, and CbCR safe-harbour tests

- Jurisdiction pack: compute, review, and reconcile by country (with substance carve-out and JV/PE handling)

- GloBE Information Return XML export & pre-validation against OECD schema

- Threshold tracking with 15% line, alerts when ETR falls below, and top-up sensitivity to adjustments/credits

- Safe harbour automation (Transitional CbCR; QDMTT safe harbour where applicable)

- Comprehensive audit trail for all calculations and adjustments

- Configurable dashboards with Pillar Two compliance analytics

- Secure storage of financial data, calculations, and regulatory filings

Services

Every Pillar Two implementation comes with hands-on guidance to ensure your GloBE calculations and filings stand up to regulatory review. We work with your team to map group entities and configure jurisdiction-specific rule sets, including transitional-qualified regimes, while setting up safe-harbour tests and managing all required Pillar Two notifications and filing workflows. We also handle GIR XML onboarding by providing OECD-compliant schemas, test files and validation steps. Whether you implement directly with Supernomial or through one of our boutique consulting partners, you gain not only automation but also the specialist support needed to satisfy tax authorities and maintain an audit-ready evidence pack aligned with OECD error codes.

How to get started

Start your Pillar Two compliance journey today. Our platform provides all the tools you need to compute GloBE ETR and top-up tax efficiently.

Need GIR XML and QDMTT/IIR covered end-to-end? Let’s scope filings, timelines, and data flows for your group.